Personally, I think filing should be easy. I have yet to meet someone who enjoys the actual act of filing. We all love a perfect filing system, but why are the papers piling up on our desks? We do not like filing.

I am going to use my personal filing system as an example and answer questions about your filing system, or lack thereof, whichever the case may be.

First, it has to be easy! My system is easy because the three most used components are two decorative boxes and an expandable file. That’s right! I receive very few physical bills – water and gas. All other bills are delivered electronically. Some I print and some I do not. I also receive monthly statements from several charities we support. There is no getting around that, they mail them out anyway. Box 1 is for the water and gas bill. I may also add an occasional receipt that doesn’t need to be kept for business purposes. Box 2 is for our construction business. All receipts needed for tax purposes are tossed in here. I say tossed but they land nice and neat in chronological order! This box has receipts for water and power to hubby’s shop, tools, fuel, etc. things needed for his business. Charity statements received go in this box; one on top of the other in order. In other words, everything needed for taxes goes in this box.

I sometimes laugh because when I first met my husband he kept his business receipts in a box and then took the box to the accountant at tax season. It was a mess! When you say I keep my receipts in a box, what comes to mind? A messy shoebox! I rest my case. Things changed quickly and I developed a filing system and began doing his books. We also changed accountants and the accountant never felt the need to look through the receipts. My system was complete and made his job easy. He told me he didn’t need to sort through everything because he trusted my system. What is funny is that things have come full circle as they say. Receipts are back in a box! Only they are organized. I did say I hate filing! At the end of the year, I simply gather up the receipts and put them in an expandable file along with my QB report and I’m ready for the accountant. If a receipt (and this has never happened) is needed, everything is in chronological order and easy to find. Once taxes are done and checks paid/received, the file is marked with the year and is added to a filing cabinet.

We have two businesses that I need to keep receipts for tax purposes. My husband’s contracting business and our construction/rental company. I also keep the monthly water, gas, and power bills for a year. I haven’t quite figured out why. Lol Old habits die hard I guess.

Since it is the beginning of the month, I think it is a good time to talk about my system. By the first of the month, most bills have arrived. I use QuickBooks on my computer rather than a physical checkbook. I abhor paper clutter and try hard to not let it build up unnecessarily. And, guess what?! Quickbooks does the math for you! Win-Win!

As the water and gas bills arrive, I record them in QB (QuickBooks), set the payment on my bank site, record the numbers in a spreadsheet, and toss in a box. I know the charities we donate to and also record them in QB. I do not have to wait for monthly statements. They are set to pay automatically from the bank, so that is it for recording the charities. When the statements arrive, I toss them into the appropriate box.

I print out the internet bill, power bills, and phone bills from their appropriate websites as these are needed for tax purposes. They are available at different times so as I receive emails stating their availability, I print them and set them for payment on my bank site. The power bill is sent to the bank and automatically adjusted.

I do not normally print out credit card statements. I pull out my receipts and match them to charges using the statement on my computer. I don’t need the statements for tax purposes and if I would, they are easily available. After reconciling the statements, I set them up in Billpay (bank). I add the receipts to the business box if needed and shred the rest unless the receipt is needed for a large purpose that I might want to keep. (The top box is where I keep my receipts for the month, checkbook, and stamps – in reach of my desk.)

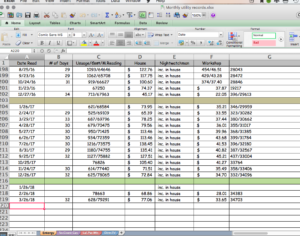

I mentioned recording water, gas, and power bill numbers on a spreadsheet. I’ve done this for years. I truly do not remember why I began this but it did have a purpose. I guess I still do it out of habit. The spreadsheet is on my computer, so no paper mess. I use Excel and each bill has its own page. I record the date read, usage, amount and date paid. It takes about 15 seconds to do and I’m done. Old habits die hard. I will say that it has come in handy. Our power bill was almost triple one month and I had all the ammo I needed to argue that my bill was incorrectly read. They did not want to come out and reread the meter and at the time there was no way I could afford what they claimed we owed. I pulled up my spreadsheet and imagine their surprise when I read all the readings for the preceding year to her, proving that the bill was not correct. It was obvious no one had ever argued so well. Result? They reread the meter. My motto is to be prepared. I had no bill, but I had my ducks in a row!

That pretty much sums up my filing system for personal finances. If you do not have a business and need to save receipts, I would still advise keeping receipts in your file or box for a year. Believe me, I’ve never heard of the water or gas or power company coming back for payment (if you’ve paid.) I empty the box and burn or shred the bills. And, unless you need to dispute a credit card charge, normal receipts can also be shredded.

For our construction/rental company, I skip the box and use the expandable file and file as I go by months. I actually put twelve folders inside of the expandable (one pocket) folder and file each month. At the end of the year, I pull these twelve folders out and insert them into a new expandable file. I label the previous file with the year and I’m ready for the accountant. I run a QB report, export to a jump drive and I’m done. (See that green expandable file.)

If anyone is interested in how I keep track of all the permits and COIs and insurances needed for our company, let me know and I will write a breakdown of my system.

Thanks for stopping by. I hope you found the post helpful.