How many of you dread that end of the year thing where you are scrambling around trying to corral all the papers you need to file your taxes? Wow! That’s too many of you!

When my Hubby retired from the State Police a few years ago, we started up a small construction/rental company, and you guessed it – as much as I ADHORE numbers, I became a make-shift accountant. My life has become my biggest nightmare!

Before Hubby retired, he also trawled (we live in Southern Louisiana and it’s what you do) to supplement our income. It was at this time, being the organizer I am, that I set up our accounts in an organized manner – that is, I destroyed his old filing system (a shoe box – literally!) If you fall into the category of small business owner and your files are not huge and complicated, my system will work for you. It will also work if you just need to hold on to a few things in order to make deductions.

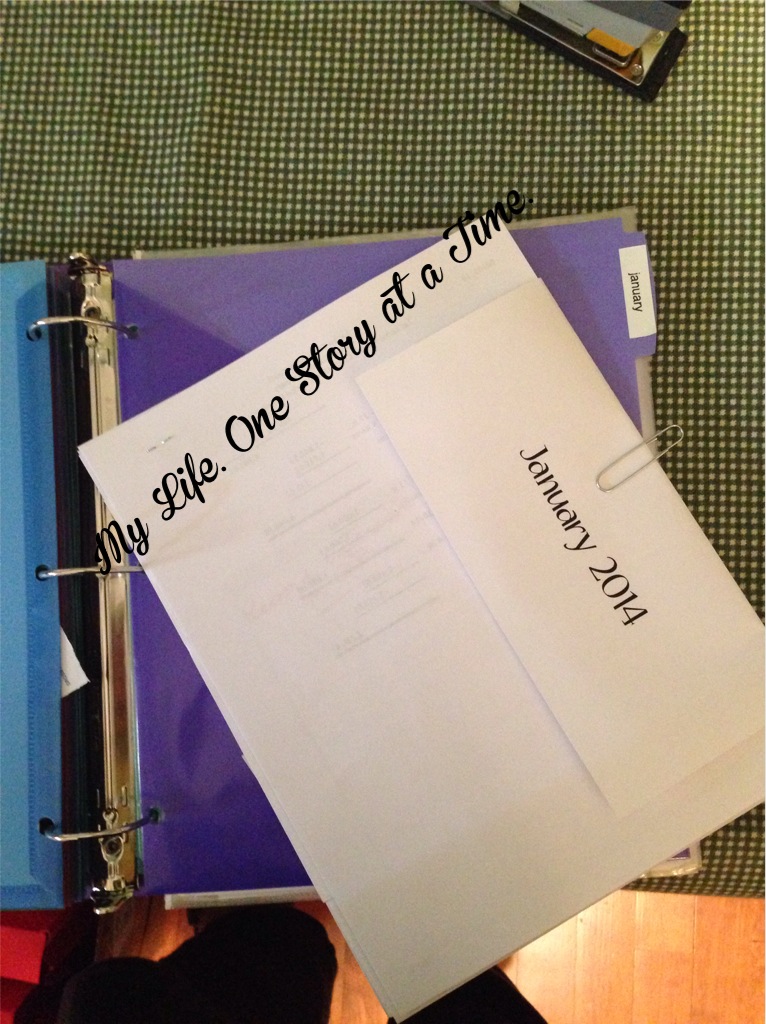

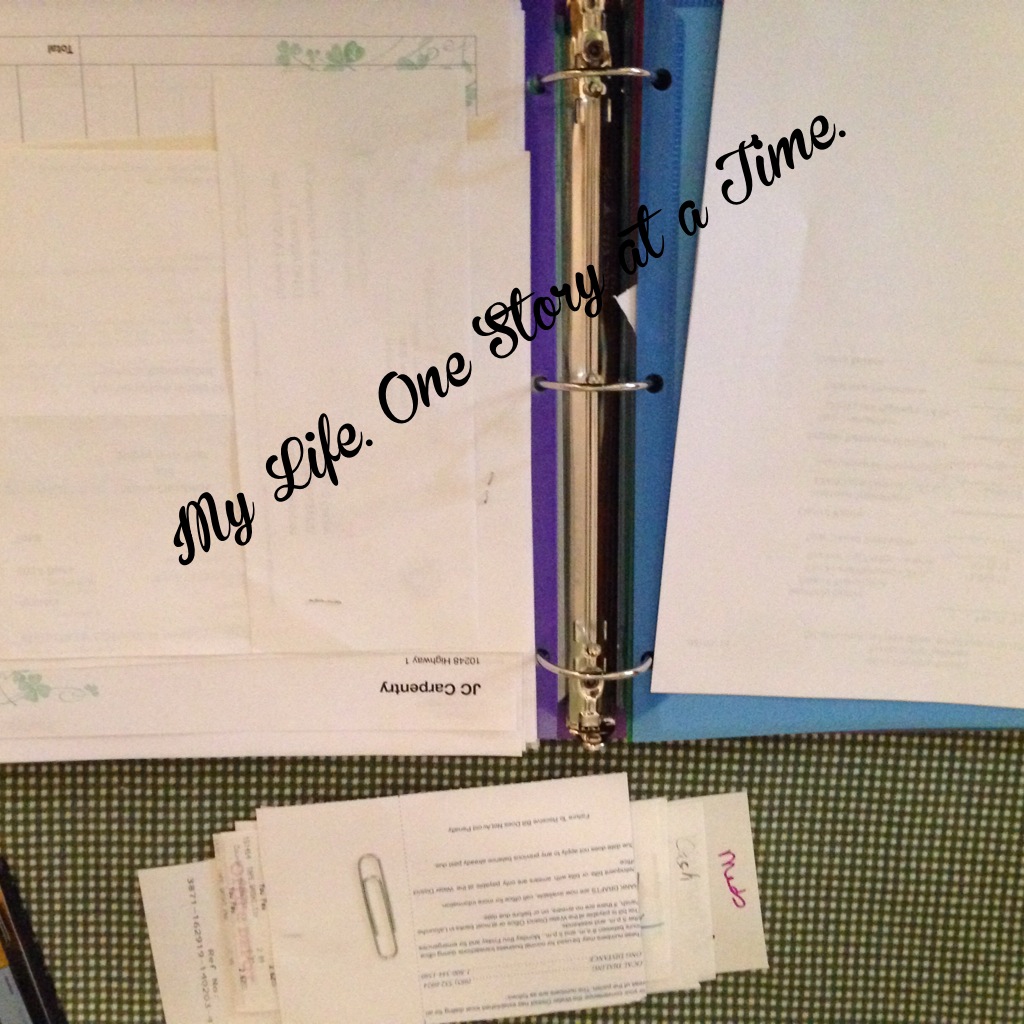

I currently use Quickbooks on the computer, but in the beginning, all I used was a ledger sheet and it worked beautifully. To set yourself up, you will need a three-ring binder (choose an appealing color and you’ll be much more likely to continue this practice – I know, I like pretty.) You will need either plastic dividers or plastic divider folders (Avery makes these). I prefer folders because they are easier to put the papers in. They come in a multitude of colors and you will need enough for year (12) and a couple of extras. Next up is labels (or not – you can handwrite on the dividers) and an expandable file (for year’s end.) And, in case I forget – did I mention how economical this filing system is? It is! You may have most of the supplies already lying around the house.

Recap:

3-ring binder, separating receipts at end of month

- 3-ring binder (at least 2-3″)

- plastic divider pockets

- labels

- expandable file

When I first set up my file, I used a label maker and labeled each folder with a month. I then put the folders in the binder with December on top and worked my way back. I did originally set it up with January in the front, but as the year progresses, the files are harder to turn. Trust me here, December to January with the extra files in the front. I use the unlabeled folders for pending items or when I need a reminder to handle something, etc. You may or may not use these every year.

Place one empty folder at the back. You will file the bills here that you do not need for tax deductions – power, water, gas, etc. These bills you can toss at the end of each year. Just file the new month in front of the old to keep them in order in the event you need to quickly find it. In the other files – monthly – you will file the bills and items that you use for deductions.

I put the electricity and water bills for Hubby’s workshop, fuel bill, phone and internet bills, etc. that are deductible along with their payment record. I also file his invoices and payments as well as a Profit & Loss sheet and the bank statement. I do not file bank statements separately because they are available on-line should you need one. I file these along with all the tax-deductible items in an expandable folder at the end of the year, mark the year on it and file it away.

At the end of the month, once the bank statement is reconciled, I print the month’s Profit & Loss and then pull all of the papers from the folder. I corral all of the fuel receipts and other little receipts and staple them together and then paperclip all of the papers together and attached the “January” page, and put them back in the folder until the end of the year.

I continue this procedure for each month. At the end of the year, each month is taken from the folder and placed in the yearly file (expandable file) and labeled along with the yearly Profit & Loss sheet, and all 1099s. That’s it. I am ready for the accountant.

I also have the same set up for our business files for our company. We build rental houses and each house has its own file because we frequently reference the costs of items as we purchase them again. It is much easier to pull a house file than to start digging through receipts in a folder. I tried a couple of different ways of organizing before I developed this system that is tailored for our needs. Other than the house files, all other receipts, etc. are filed according to month. In the business binder, I also keep a supply of checks for when I need them. It is much easier than having to grab the huge check box every time I need a check – which isn’t often because I use on-line bill pay at the bank.

The last part of my filing system happens after we’ve been to the accountant. I take the files he provides me with after filing our taxes and these go in the front of the expandable file before the file is packed away.

Well – this is my system. It is a very quick and easy system to use. If you have any questions, please feel free to comment. I’ll try to answer them as best I can. My motto is why make something complicated when you don’t have to. Work efficiently. You’ll have more time to play.

A note: This post is only about my tax keeping system. There is a lot more to the day-to-day business operations that require additional files. You know – those pesky pending payment files and licenses to be paid files. That is all for another day!